Crystal City Council Addresses Proposed 15.87% Tax Levy Increase

On its Oct. 7 agenda, the Crystal City Council provided opportunity for public input on its 2026 budget — a preliminary budget where residents will see a proposed 15.87 increase to the city’s tax levy.

The proposed increase comes on top of a 16 percent increase last year and a 10 percent increase the year before that.

During the Oct. 7 meeting, elected city leaders said they understand the concerns about double-digit increases in the face of tightening budgets and rising costs impacting many families.

“There’s no whimsical spending here,” said Crystal City Council Member John Budziszewski.

Council members have spent many hours over the past few months scrutinizing the budget, Budziszewski said.

According to Crystal City Manager Adam Bell, the city’s tax levy has been considerably lower than surrounding communities in recent years. He referenced New Hope, a peer suburb whose tax levy was $4 million more than Crystal two years ago. Bell said the city can’t sustain services without increasing taxes.

“Crystal has been undertaxing comparatively to a lot of the neighboring communities,” said Bell. “The city has been able to get away with not having the revenue to keep providing the services. We kind of have come to the end of that being feasible. We can’t kick the can down the road any further.”

Bell said lowering the levy would likely mean reducing services and eliminating city worker positions.

How Did Crystal Get There?

Crystal city leaders say a myriad of factors have led to this point.

For starters, the city has paid for cash for several major projects in recent years, such as a new pool at Crystal Cove Aquatic Center and a new public works facility. It caused the city to dip into its reserves.

“Thirty-five percent of our total budget, we should have in our bank account to pay for things for the next year,” said Crystal City Council Member Taji Onesirosan. “We do not have that in our bank account right now and we are working to increase that. That’s because over the last several years we have paid for things in cash and have depleted our budget without adequately replenishing our funds.”

The city has also made investments in public safety, which account for nearly half — or 46 percent — of general fund expenditures. The 2026 budget includes the addition of a new police officer.

City leaders also point out that Crystal, unlike some neighboring communities, doesn’t do street assessments or franchise fees, resulting in a higher property tax levy.

Rising labor costs and inflationary pressures are other drivers in the levy increase. Total wages and benefits compose 52 percent of the tax increase, said Bell. Recent labor negotiations with the police union contributed to that.

Bell said Crystal police officer salaries are now averaging closer to peer communities.

Onesirosan believes this tax levy hike will be the worst of it. He sees future tax levies ramping downward.

“My opinion is that this will be the highest levy we’ll see,” said Onesirosan. “I am committed to seeing it decrease over the coming years. And actually I think we’ll get in the single digits, in the next few years.”

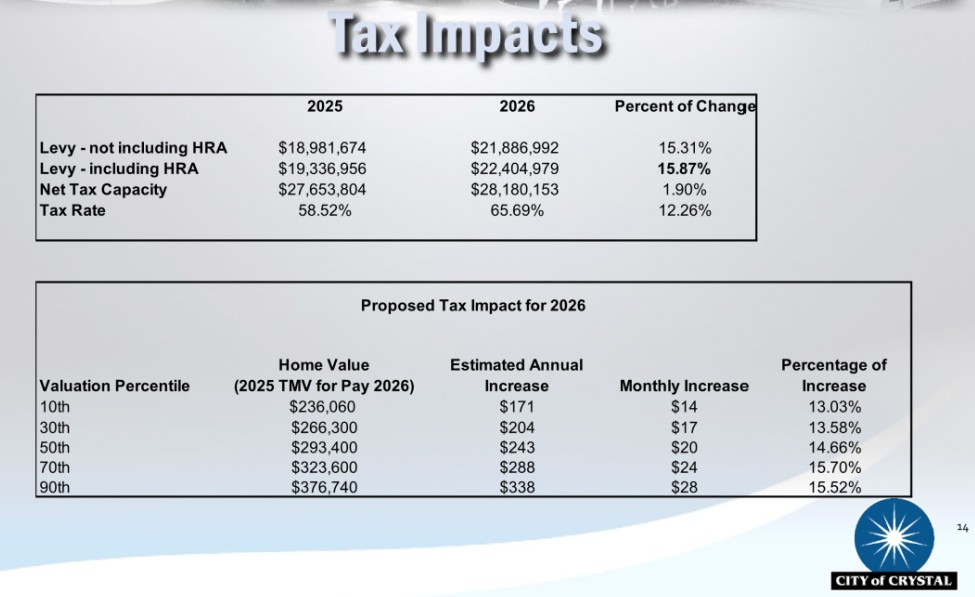

Impact of tax levy on various home values/Courtesy city of Crystal

What Levy Increase Means for Median Home?

Despite the explanations, residents raised concerns at the recent meeting, fearing the impact on those with fixed incomes.

“This is something the residents have to absorb. And we’re all under budget crunches,” said Dave Bissen, one of the residents who spoke at the Oct. 7 meeting. “And this on top what I think is a pending 8 percent [increase] from Hennepin County.”

Based on the proposed 15.87 percent tax levy increase, owners of a $293,400 median-value home in Crystal would pay $243 more annually in taxes, a 14.7 percent increase.

The levy impact of adding a police officer to the staff is about $1 per month for the median home, said Bell.

The Crystal City Council could still lower the proposed levy increase. The city council is slated to approve a final levy and budget at its Dec. 2 meeting.