Twin Cities Housing Market ‘Feels Like We’ve Reached a Turning Point’

There are promising signs in the housing market for those trying to buy a home in the Twin Cities. One of the most encouraging signs for buyers: the number of listings has increased.

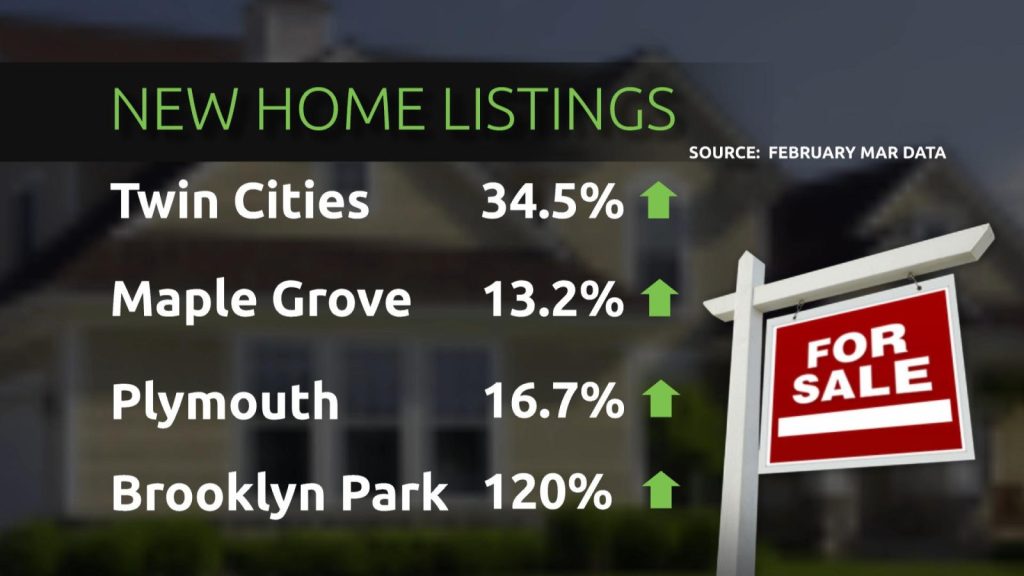

Listings jumped 34 percent last month in the Twin Cities metro compared to the year prior, according to data released Monday by Minneapolis Area Realtors and the Saint Paul Area Association of Realtors.

In Maple Grove, new listings went up 13.2 percent in February with 77. In Plymouth, it was a 16.7 percent increase with 105 new listings. And in Brooklyn Park, new listings more than doubled from 40 last year to 88, a 120 percent increase.

“Perhaps it’s still early to make the call, but it sure feels like we’ve reached a turning point,” said Jamar Hardy, president of Minneapolis Area Realtors. “Despite the market ramping up, buyers are still cautious and deliberate, but also more optimistic.”

Favorable mortgage rates of around 2 to 3 percent have caused many homeowners to hold off on selling. The average rate for a traditional 30-year fixed mortgage today is 6.88 percent, according to Bankrate.com.

Meanwhile, the median sales price in the Twin Cities rose 4.5 percent last month to $357,700.

Realtors say that while signs show the grip from the so-called “rate lock-in effect” loosening, buyers should also expect more competition from pent-up buyers. That’s because inventory remains tight. There is currently a 1.8-month supply of inventory. Four to six months of supply is considered a balanced market.

Also See: Maple Grove Realtor: 2024 Home Sales Outlook Shows ‘Promising’ Signs