Gov. Walz, Elected Officials Tout Tax Rebates at Capitol

Most Minnesotans will see tax rebate money coming back from the state beginning this week.

More than 2 million households will receive one-time payments, starting at $260 for an individual, $520 for a married couple and an additional $260 apiece for up to three children. That caps at $1,300 for a family of five.

Minnesota Gov. Tim Walz (DFL) said many of those payments are already in bank accounts with direct deposit set up.

These payments come after the state’s previously projected $17.5 billion budget surplus.

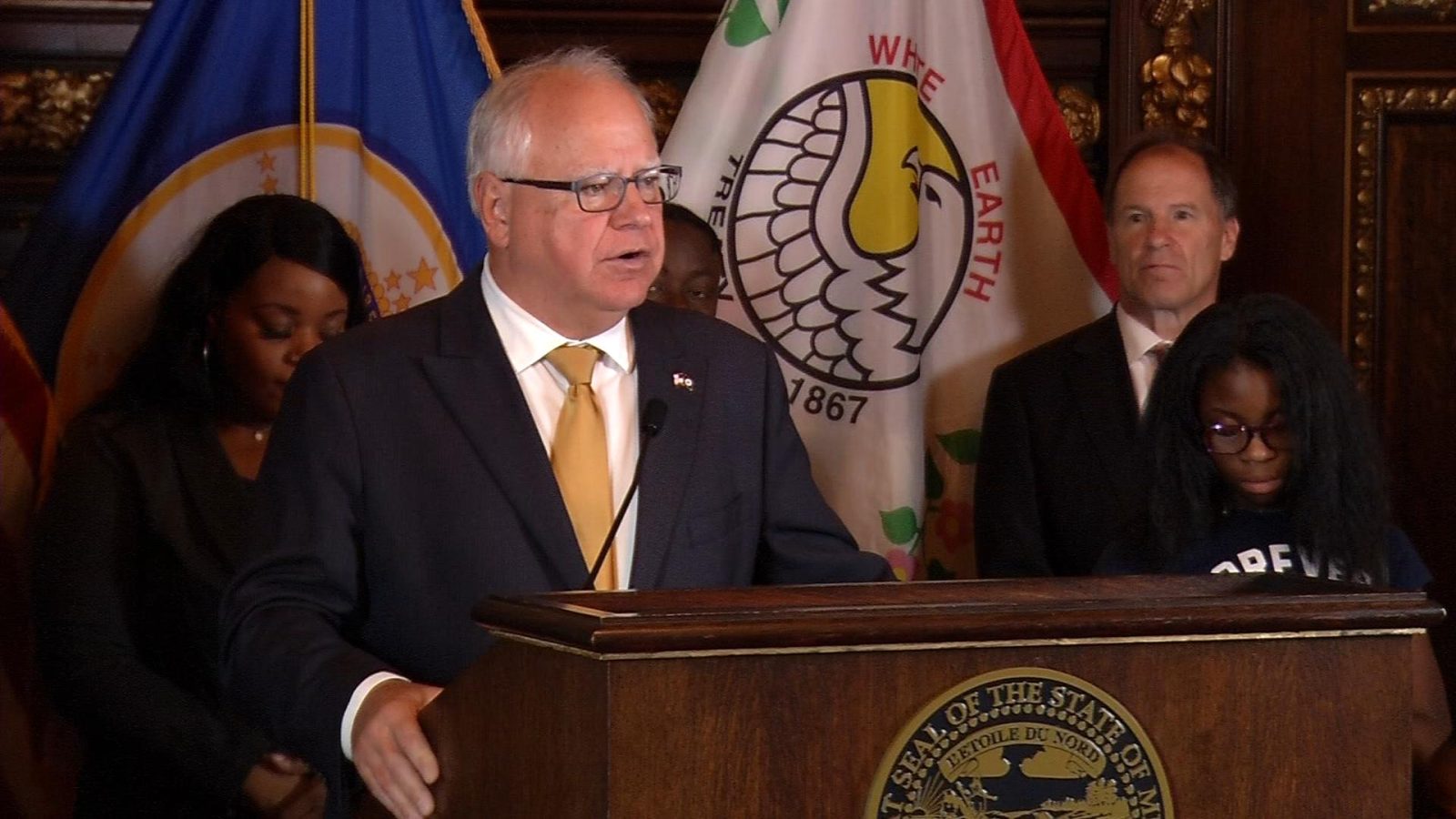

At a news conference Wednesday, Walz and other leaders celebrated those tax rebates. He said the payments come at a perfect time as families prepare to send their kids back to school.

“We all know the stress of it, all of our families know. It is an expensive time of year to get ready to go back to school,” Walz said. “It is a time that can be more exciting for the kids when that financial stress is not there.”

At a news conference Wednesday, Gov. Tim Walz and other elected leaders celebrate the tax rebates being distributed starting this week.

More Money in Minnesotans’ Pockets

Sate Sen. Ann Rest from New Hope co-authored the legislation. Rest said her Republican colleagues pushed for zero-dollar tax rebates. She said the work that it took to bring the total up for families was more bicameral than bipartisan.

“We came up with over $1,300 for a family of five, and it is going to make such a big difference that it is coming now and it is cash,” Rest said.

Rest said as she worked on this bill and other pieces of legislation like the Free School Meals for Kids Program, she kept the families in her district in mind.

To be eligible for the rebates, you had to be a Minnesota resident for part or all of 2021, have filled out your tax returns and to have made either $150,000 or less as a married filer, or $75,000 or less for others. You also could not be claimed as a dependent in 2021.

For families without direct deposit set up, paper checks will be mailed out by early September.