Sen. Rest Pitches Using Target Field Tax for Medical Buildings

A bill being considered at the legislature could redeploy the Hennepin County sales tax revenue that originally helped to pay for Target Field and instead use it to fix county-owned medical facilities.

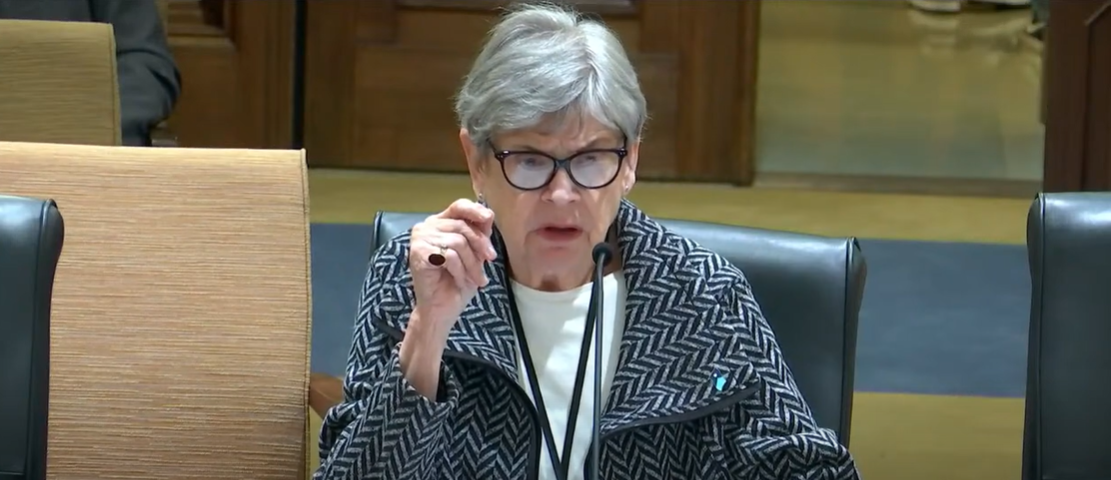

Minnesota Sen. Ann Rest (DFL-New Hope), who chairs the Senate Tax Committee, is a co-sponsor of the bill.

“This really does flip the coin, and what we have found throughout the metropolitan area is a dire need for upgraded healthcare facilities,” Rest said as she presented the bill in committee hearing on Tuesday, April 10.

A .15 percent sales tax in Hennepin County has been used to pay off the debt from building the Twins ballpark.

According to county officials, Target Field will be paid off about a decade earlier than was originally planned.

Instead of phasing out the sales tax, the new proposal would dedicate about 80 percent of the revenue to capital projects at county-owned medical facilities.

Some funding would continue to pay for Target Field maintenance, as well as libraries and youth sports.

Sen. Ann Rest (DFL-New Hope) talks to the Senate Committee on Taxes on April 9. She’s co-sponsor of a bill that would redeploy the Hennepin County sales tax revenue that originally helped to pay for Target Field and use it to fix county-owned medical facilities.

Rest Aims for Omnibus Bill

Rest said she’s hoping this legislation is included in the omnibus tax bill this legislative session.

Irene Fernando, who represents parts of Plymouth and Golden Valley on the Hennepin County Board of Commissioners, said the county never turns away patients based on finances.

“In so many ways, the health outcomes for all of Minnesota depend on a well-run, extensive county health system,” Fernando said.

Two of Hennepin Healthcare’s clinics are located in Brooklyn Park and Golden Valley.

Meanwhile, Stella Whitney-West, the CEO of Northpoint Health and Wellness Center in north Minneapolis, said the financial needs are county-wide.

“We believe that all Hennepin County needs resources and facilities like this,” she said. “Our impact is real. When the county invests in high-quality healthcare, infrastructure, people and communities benefit.”