Maple Grove Explains How It Spends Property Tax

City of Maple Grove Finance Director Greg Sticha said the tax levy the city council approves every December–up almost seven percent in 2025 over the previous year–goes to help pay for the hundreds of city employees, their benefits, and many city services.

“Roughly 65 percent of the entire general fund budget is wages and benefits for its employees,” said Sticha. “So our business is providing services for people and those services are provided by our people.”

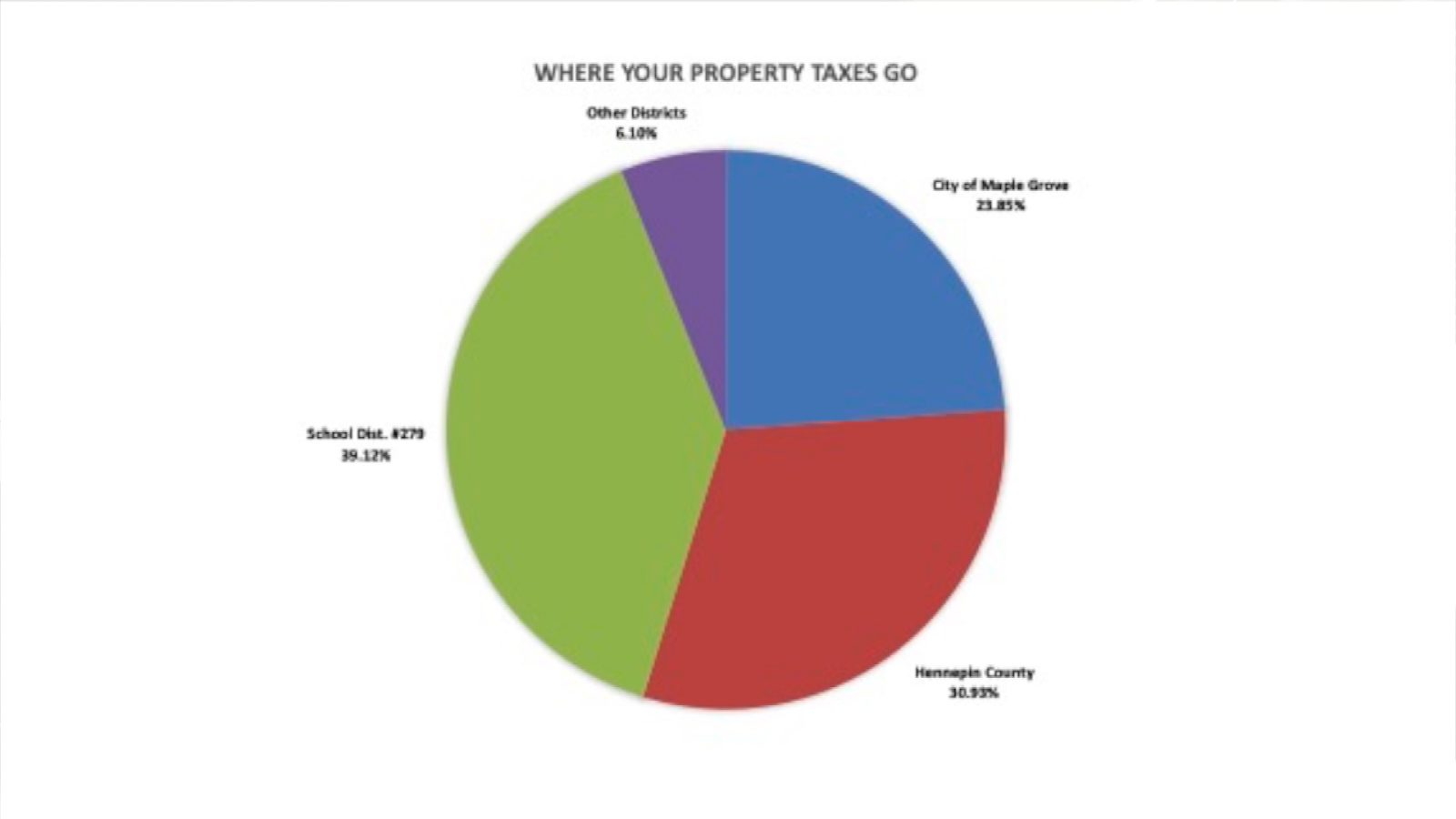

In the city’s 2025 budget, Sticha said there’s a breakdown of how your property tax bill, which usually is out in the spring, is divided among local jurisdictions.

City of Maple Grove budget graphic (2025)

“In comparison, the city levy is smaller in size compared to the county and school district levies, which is pretty standard for a growing suburb like Maple Grove,” said Sticha.

He also said the city helps pay for some of its services, like utilities and some construction, through a fee structure attached to utility bills.

“If you’re hooked up to city water, you’ll pay a utility bill that pays for your water and sewer portion for living in the city,” he said. “We have a separate fee for those, collected separately from property taxes.”

Sticha said the reality is the city wants to be an attractive place for people to work.

“Inflation was still rather high in 2024 and still will be in certain areas in 2025, as well as wage pressures that are impacting the city, continuing to stay competitive with our wages and our benefits, which this past year was one of the strategic goals of the council,” he said. “In the 2025 budget, it includes increases toward health insurance for employees in particular. We paid a lot of attention the past year for our family plans to try to make those more competitive with some of our neighbors, as well as cost of living increases and other adjustments to compensation plans.”